International shipments: do you know how to use CN23?

The CN23 form is one of the most common documents used by companies wishing to export goods outside the European Union. Completing this document is not that complicated, but it is essential to fill it out correctly to ensure the success of your shipments. But don't worry: we will explain everything step by step.

What is a CN23 form?

The CN23 form is a customs declaration document used for shipments outside the European Union (EU). It must be filled out carefully and accurately in order for the shipment to cross the border smoothly.

The CN23 form contains important information about the exported goods, such as their description, value and weight. This information allows the customs authorities in the receiving country to verify the nature of the goods and to ensure that all taxes and duties have been properly paid.

It is important to fill out the CN23 form correctly to avoid delays or detention at the border. Errors or omissions can result in delays in the delivery of the goods and additional costs (including a fine of up to 100% of the value of the goods).

The CN23 should not be confused with the CN22 form, which is used for low-value (less than €380) and low-weight (less than 2kg) shipments. Shipments weighing more than 2kg and worth more than €380 must therefore be accompanied by a CN23. The CN23 also requires more detailed information about the products, such as their customs tariff number and country of origin, unlike the CN22 which requires more basic information such as the description of the item and its value.

What is the purpose of a CN23 form?

The CN23 customs form is used to declare the content and value of the exported goods. It is used to determine duties, taxes and fees for the export of goods.

The CN23 form also allows customs to check the goods to be exported to ensure that they are legal and comply with the regulations of the destination country.

Where to find the CN23 form?

The CN23 form is available online, as well as at the post offices and shipping agencies you use to send your package. If you want to fill out the form online, you can find it on your carrier's or local postal service's website. Many carriers also offer online filling tools to help you complete the CN23 form efficiently.

If you prefer to fill out the form manually, you can visit your local post office or shipping agency to pick up a blank CN23 form. The post office or shipping agency staff will be able to provide you with guidance on completing the form and answer any questions you may have. If you choose this option, it is important to use a black pen and to write in block letters so that all information is clear and legible.

How to fill out the CN23 form?

The first step is to gather all the information required to complete the form. You will need a detailed description of your products, their weight, value and country of destination. The CN23 form is made up of several parts, and each part must be completed accurately.

Here is the information needed to complete each part of the CN23 form:

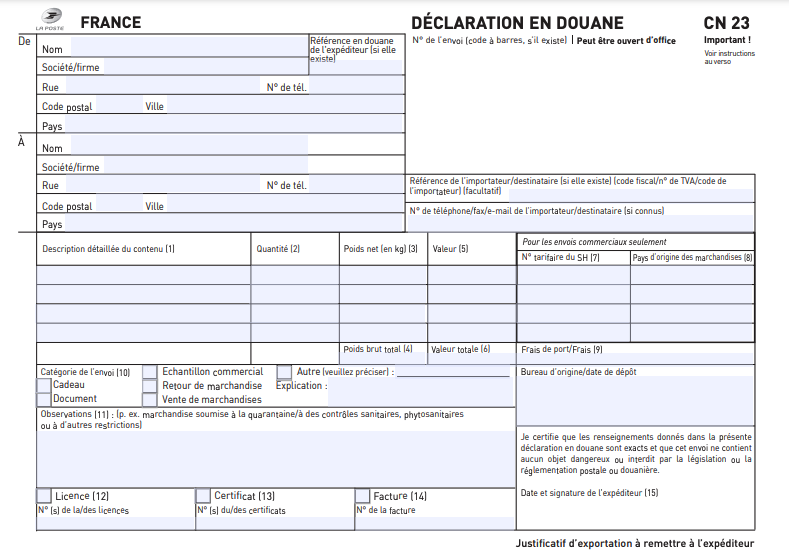

Example of form CN23 La Poste

Example of form CN23 La Poste

1.Sender

The top portion of the CN23 form is for the shipper and must be completed with the following information:

- Full name and address of the sender

- Telephone number and e-mail address of the sender

2.Recipient

The following section is for the recipient and should be completed with the following information:

- Full name and address of the recipient

- Telephone number and e-mail address of the recipient

3.Carrier

In this section, you must fill in the name and address of the carrier.

4.Shipment details

In this section, you must provide the following information:

- The weight of the exported goods.

- The value of the exported goods.

- Detailed description of contents and quantity of products.

- The category of the shipment: gift, document, commercial sample, return of goods, sale of goods or other category.

- For commercial shipments only: the country of origin of the goods and the HS code of each product (the HS code is the international code used to classify products for customs purposes).

5.Observations

Certain additional information may be requested, such as whether the goods are subject to quarantine, sanitary controls or other restrictions.

6.Signature

Finally, the CN23 form must be signed and dated by the sender or his representative to certify the accuracy of the information provided.

Once you have completed all sections of the CN23 form, you must attach it to your shipment along with a commercial invoice.

The commercial invoice contains additional information about the shipment, including the cost of each product and payment terms.

It is important to fill out the CN23 form accurately to avoid any problems with your shipment. If you are unsure how to complete the CN23 form, please contact your carrier or local postal service for assistance.